The IPO Week

Nine IPOs

Crypto IPOs Continue to Impress as Bullish Prices IPO Shares $6 Above the Intial Price Range's Top End, Raising $1.1 Billion

Cayman Islands-Incorporated Company Operates Global Digital Asset Platform

JPMorgan, Lead Manager for Bullish, Brings Miami International Holdings to Market

2025 Has Seen Two SIC 6211 (Security Brokers, Dealers & Flotation Companies) Deals After Only One In the Previous Three Years

NusaTrip Completes First IPO In U.S. by Indonesian Company Since 2019

Online Travel Agency Raises $15 Million In Its Debut

Japan's rYojbaba, Provider of Labor and Corporate Consulting Services, Is Publicly Traded

Company Spent Just Over a Year In Public Registration

Singapore-Based Electrical Installation Services Company Magnitude International Prices

SIC 1731 (Electrical Work), Which Had Not Produced a U.S. IPO In 20 Years, Completes Second Offering of 2025

Israel's Nasus Pharma Nets $10 Million for the Development of Intranasal Drugs for Medical Conditions

Of 15 Israeli New Issuers Since Start of 2022, Nasus Is the Only Pharmaceutical Prep Company

New Issuer BUUU Group, Provider of Event Production Services, Is Incorporated In British Virgin Islands but Operates Out of Hong Kong

172 of 2025's IPO Companies Are Incorporated Outside the U.S., 21 In the British Virgin Islands

Highview Merger and McKinley Acquisition Add to Year's Fast-Growing SPAC IPO Total (81)

McKinley Lead Underwriter Clear Street Has 14 Completed IPO Assignments This Year, All But One of Which Are for Blank Checks

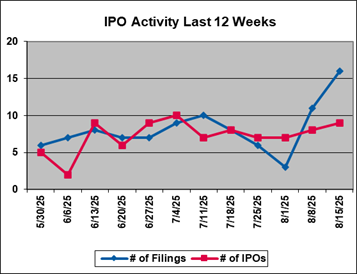

Sixteen Initial IPO Filings

Half of Week's Preliminary Registrants are U.S.-Based SPACs; Five New Filers are Headquartered In Hong Kong

Gemini Space Station, Winklevoss Twins' Crypto Services Company, Taps Goldman Sachs to Lead Its IPO

Gemini's Crypto Platform Includes Derivatives Exchange, Staking Services, Trading Desk, Stablecoin, and Credit Card

Company, Which Will Remain Under Control of Its Co-Founders, Will Include Directed Share Program In Its Offering

Goldman Is Hired as First Lead Manager by Legence and Via Transportation

Legence, Which Will Conduct IPO Using Up-C Structure, Provides Engineering Services to Upgrade Buildings' Mechanical and Electrical Systems

Via Transportation Designs Software to Convert Antiquated Public Transportation Systems Into Smart, Data-Driven Digital Networks

Cohen & Co.'s Busy Week Includes Five Lead Manager Assignments for New Blank Check Registrants

Apex Treasury, Dynamix Corp. III, Tailwind 2.0 Acquisition, Talon Capital, and Viking Acquisition I Enlist Cohen

Cohen & Co. Has Benefitted from SPACs Reemergence; All 14 Companies It Has Led to Market This Year are SIC 6770 Companies

New Public Registrants ECST Holdings, JM Group, and Fitness Fanatics Hail from Hong Kong

ECST Offers Enterprise Resource Planning Solutions for Hong Kong Businesses Looking to Improve Operational Efficiency

Fitness Fanatics Distributes Sports Nutrition Products; JM Group Sources and Sells Consumer Products to Retailers and Wholesalers

Education Services Provider Monkey Tree Investment and Clean Energy Co. Solar Strategy Holdings, Both Hong Kong Headquartered, Register

Monkey Tree, Which Offers Children's Language Learning Courses, Hired Revere Securities as Lead Underwriter

Kingswood Is Lead Manager for Solar Strategy, Which Hopes to Raise $6.9 Million for Solar Energy Project Services Business

SPACs AI Infrastructure Acquisition, Cantor Equity Partners V, and GigCapital8 File Preliminary Registrations

AI Infrastructure Will Seek Entities Advancing AI Capabilities; Cantor Equity V's Focus Includes Financial Services, Digital Assets, and Healthcare

GigCapital8 Will Target Aerospace and Defense, Cybersecurity, Command and Control Systems, AI, and Machine Learning Industries

One IPO Withdrawal

February 2023 Filer Earntz Healthcare Products Backs Out of IPO Plans

Chinese Maker of Nonwoven Fabrics and Related Products Amended Its Public Registration Three Times, But Not Since Last September

| IPO Offerings | Form Type | 1st Lead Manager Listed |

Initial Filing Date | Offer Date |

|---|---|---|---|---|

| Highview Merger Corp. | 424B4 | Jefferies LLC | 7/23/25 | 8/11/25 |

| McKinley Acquisition Corporation | 424B4 | Clear Street LLC | 6/30/25 | 8/11/25 |

| Bullish | 424B4 | JPMorgan Securities LLC | 7/18/25 | 8/12/25 |

| Magnitude International Ltd | 424B4 | Bancroft Capital, LLC | 5/28/25 | 8/12/25 |

| Nasus Pharma Ltd. | 424B4 | Laidlaw & Company (UK) Ltd. | 7/9/25 | 8/12/25 |

| BUUU Group Limited | 424B4 | Dominari Securities LLC | 3/28/25 | 8/13/25 |

| Miami International Holdings, Inc. | 424B4 | JPMorgan Securities LLC | 7/18/25 | 8/13/25 |

| rYojbaba Co., Ltd. | 424B4 | D. Boral Capital, LLC | 8/2/24 | 8/13/25 |

| NusaTrip Incorporated | 424B4 | Cathay Securities, Inc. | 3/21/25 | 8/14/25 |

| Initial IPO Filings | Form Type |

1st Lead Manager

Listed |

Initial Filing Date | |

|---|---|---|---|---|

| Apex Treasury Corporation | S-1 | Cohen & Company Capital Markets | 8/11/25 | |

| Dynamix Corporation III | S-1 | Cohen & Company Capital Markets | 8/11/25 | |

| Fitness Fanatics Limited | F-1 | Bancroft Capital, LLC | 8/11/25 | |

| GigCapital8 Corp. | S-1 | D. Boral Capital, LLC | 8/11/25 | |

| Tailwind 2.0 Acquisition Corp. | S-1 | Cohen & Company Capital Markets | 8/12/25 | |

| AI Infrastructure Acquisition Corp. | S-1 | Maxim Group LLC | 8/13/25 | |

| ECST Holdings Limited | F-1 | Eddid Securities USA Inc. | 8/13/25 | |

| JM Group Limited | F-1 | Prime Number Capital, LLC | 8/13/25 | |

| Viking Acquisition Corp. I | S-1 | Cohen & Company Capital Markets | 8/13/25 | |

| Cantor Equity Partners V, Inc. | S-1 | Cantor Fitzgerald & Co. | 8/15/25 | |

| Gemini Space Station, Inc. | S-1 | Goldman Sachs & Co. LLC | 8/15/25 | |

| Legence Corp. | S-1 | Goldman Sachs & Co. LLC | 8/15/25 | |

| Monkey Tree Investment Limited | F-1 | Revere Securities LLC | 8/15/25 | |

| Solar Strategy Holdings Limited | F-1 | Kingswood Capital Partners, LLC | 8/15/25 | |

| Talon Capital Corp. | S-1 | Cohen & Company Capital Markets | 8/15/25 | |

| Via Transportation, Inc. | S-1 | Goldman Sachs & Co. LLC | 8/15/25 |

| IPO Withdrawals | Form Type | 1st Lead Manager Listed |

Initial Filing Date | Withdrawal Date |

|---|---|---|---|---|

| Earntz Healthcare Products, Inc. | RW | Revere Securities LLC | 2/15/23 | 8/15/25 |

The IPO Line-Up

IPO Line-Up Rises Two to 124 Eight-Week Active Registrants

StubHub Holdings Amends Public Registration for First Time, Rejoins IPO Line-Up

Amendments No. 2 by Jingrui Wang Pu Holdings Group and Klarna Group Return Them to List of Eight-Week Active Filers

Thirteen Price Ranges Filed

Eight Blank Checks Establish Price Ranges In Initial Public Registrations:

AI Infrastructure, Apex Treasury, Cantor Equity Partners V, Dynamix III, GigCapital8, Tailwind 2.0, Talon Capital, and Viking Acq. I

ECST Holdings, Fitness Fanatics, JM Group, Monkey Tree Investment, and Solar Strategy Holdings Set Price Ranges In Initial Filings

Fifteen Other Registrants File Amendments

TryHard Holdings and Texxon Holding Have Been Active In Consecutive Weeks

IPO Line-Up

(Ranked by Initial Filing Date)

The IPO Line-Up contains IPO Registrants that have had filing activity in the last 8 weeks

and have not gone public or withdrawn from registration.

IPO Registrants that are red and bold indicate that a filing with the initial IPO price range has been filed with the SEC.

| IPO Registrant | Form Type | 1st Lead Mgr Listed | Initial Filing Date | Filing w/ Initial Price Range | 6/23 - 6/27 | 6/30 - 7/4 | 7/7 - 7/11 | 7/14 - 7/18 | 7/21 - 7/25 | 7/28 - 8/1 | 8/4 - 8/8 | 8/11 - 8/15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Via Transportation, Inc. | S-1 | Goldman Sachs | 8/15/25 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Talon Capital Corp. | S-1 | Cohen & Co. | 8/15/25 | 8/15/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Solar Strategy Holdings Limited | F-1 | Kingswood | 8/15/25 | 8/15/25 | -- | -- | -- | -- | -- | -- | -- | F-1 |

| Monkey Tree Investment Limited | F-1 | Revere Securities | 8/15/25 | 8/15/25 | -- | -- | -- | -- | -- | -- | -- | F-1 |

| Legence Corp. | S-1 | Goldman Sachs | 8/15/25 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Gemini Space Station, Inc. | S-1 | Goldman Sachs | 8/15/25 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Cantor Equity Partners V, Inc. | S-1 | Cantor | 8/15/25 | 8/15/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Viking Acquisition Corp. I | S-1 | Cohen & Co. | 8/13/25 | 8/13/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| JM Group Limited | F-1 | Prime Number | 8/13/25 | 8/13/25 | -- | -- | -- | -- | -- | -- | -- | F-1 |

| ECST Holdings Limited | F-1 | Eddid Securities | 8/13/25 | 8/13/25 | -- | -- | -- | -- | -- | -- | -- | F-1 |

| AI Infrastructure Acquisition Corp. | S-1 | Maxim Group | 8/13/25 | 8/13/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Tailwind 2.0 Acquisition Corp. | S-1 | Cohen & Co. | 8/12/25 | 8/12/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| GigCapital8 Corp. | S-1 | D. Boral | 8/11/25 | 8/11/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Fitness Fanatics Limited | F-1 | Bancroft Capital | 8/11/25 | 8/11/25 | -- | -- | -- | -- | -- | -- | -- | F-1 |

| Dynamix Corporation III | S-1 | Cohen & Co. | 8/11/25 | 8/11/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Apex Treasury Corporation | S-1 | Cohen & Co. | 8/11/25 | 8/11/25 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Idea Tech Holding Limited | F-1 | R.F. Lafferty | 8/8/25 | 8/8/25 | -- | -- | -- | -- | -- | -- | F-1 | -- |

| BoluoC Acquisition Corp | S-1 | D. Boral | 8/8/25 | 8/8/25 | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Bend NovaTech Group Limited | F-1 | Revere Securities | 8/8/25 | 8/8/25 | -- | -- | -- | -- | -- | -- | F-1 | -- |

| Hall Chadwick Acquisition Corp. | S-1 | Cohen & Co. | 8/6/25 | 8/6/25 | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Sibo Holding Limited | F-1 | R.F. Lafferty | 8/5/25 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| KWF Group Holding Limited | F-1 | Pacific Century | 8/5/35 | 8/5/25 | -- | -- | -- | -- | -- | -- | F-1 | -- |

| Voltage X Limited | F-1 | WallachBeth | 8/4/25 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| Spring Valley Acquisition Corp. III | S-1 | Cohen & Co. | 8/4/25 | 8/4/25 | -- | -- | -- | -- | -- | -- | S-1 | -- |

| New America Acquisition I Corp. | S-1 | Dominari | 8/4/25 | 8/4/25 | -- | -- | -- | -- | -- | -- | S-1 | -- |

| M3-Brigade Acquisition VI Corp. | S-1 | Cantor | 8/4/25 | 8/4/25 | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Iris Acquisition Corp II | S-1 | Cohen & Co. | 8/4/25 | 8/4/25 | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Evolution Global Acquisition Corp | S-1 | Cohen & Co. | 7/31/25 | 7/31/25 | -- | -- | -- | -- | -- | S-1 | -- | -- |

| TechCreate Group Ltd. | F-1 | Revere Securities | 7/29/25 | 7/29/25 | -- | -- | -- | -- | -- | F-1 | -- | -- |

| GSR IV Acquisition Corp. | S-1 | SPAC Advisory | 7/29/25 | 7/29/25 | -- | -- | -- | -- | -- | S-1 | -- | -- |

| Caedryn Acquisition Corporation I | S-1 | Maxim Group | 7/25/25 | 7/25/25 | -- | -- | -- | -- | S-1 | -- | -- | -- |

| Westin Acquisition Corp | S-1 | A.G.P. | 7/23/25 | 7/23/25 | -- | -- | -- | -- | S-1 | -- | -- | -- |

| Invest Green Acquisition Corporation | S-1 | Cohen & Co. | 7/22/25 | 7/22/25 | -- | -- | -- | -- | S-1 | -- | -- | -- |

| Hillhouse Frontier Holdings Inc. | S-1 | Cathay Securities | 7/21/25 | 7/21/25 | -- | -- | -- | -- | S-1 | -- | -- | 8/12 |

| Collab Z Inc. | S-1 | R.F. Lafferty | 7/21/25 | 7/21/25 | -- | -- | -- | -- | S-1 | -- | -- | 8/11 |

| Drugs Made In America Acquisition II Corp. | S-1 | Cantor | 7/18/25 | 7/18/25 | -- | -- | -- | S-1 | -- | -- | -- | -- |

| Cantor Equity Partners IV, Inc. | S-1 | Cantor | 7/18/25 | 7/18/25 | -- | -- | -- | S-1 | -- | -- | 8/8 | -- |

| Acco Group Holdings Limited | F-1 | Revere Securities | 7/18/25 | 7/18/25 | -- | -- | -- | F-1 | -- | -- | 8/6 | -- |

| Club Versante Group Limited | F-1 | Joseph Stone | 7/15/24 | -- | -- | -- | -- | F-1 | -- | -- | -- | 8/13 |

| Smart Logistics Global Limited | S-1 | Revere Securities | 7/14/25 | 7/14/25 | -- | -- | -- | S-1 | -- | -- | -- | -- |

| Trailblazer Acquisition Corp. | S-1 | Cantor | 7/11/25 | 7/11/25 | -- | -- | S-1 | -- | -- | -- | -- | 8/11 |

| Kokobots Group | F-1 | AC Sunshine | 7/11/25 | 7/11/25 | -- | -- | F-1 | -- | -- | -- | -- | -- |

| KBAT Group Inc. | F-1 | Network 1 | 7/11/25 | 7/11/25 | -- | -- | F-1 | -- | -- | -- | -- | -- |

| Agencia Comercial Spirits Ltd | F-1 | Revere Securities | 7/10/25 | 7/10/25 | -- | -- | F-1 | -- | -- | 7/29 | -- | -- |

| Thunderstone Acquisition Corp | S-1 | D. Boral | 7/9/25 | 7/9/25 | -- | -- | S-1 | -- | -- | -- | -- | 8/14 |

| Off The Hook YS Inc. | S-1 | ThinkEquity | 7/7/25 | 7/28/25 | -- | -- | S-1 | -- | -- | 7/28 | 8/8 | -- |

| Global Thrive Fulfill Group Inc | S-1 | InterContinental | 7/3/25 | 7/3/25 | -- | S-1 | -- | -- | -- | -- | -- | -- |

| Emmis Acquisition Corp. | S-1 | I-Bankers | 7/3/25 | 7/3/25 | -- | S-1 | -- | -- | -- | -- | -- | 8/13 |

| Chenghe Acquisition III Co. | S-1 | BTIG | 7/3/25 | 7/3/25 | -- | S-1 | -- | -- | 7/25 | -- | -- | -- |

| Republic Power Group Limited | F-1 | Bancroft Capital | 7/1/25 | -- | -- | F-1;7/3 | -- | -- | -- | -- | 8/5 | -- |

| Zerolimit Technology Holding Co. Ltd. | F-1 | Prime Number | 6/30/25 | 6/30/25 | -- | F-1 | -- | -- | -- | 7/28 | -- | -- |

| JuNeng Technology Limited | F-1 | Pacific Century | 6/27/25 | 6/27/25 | F-1 | -- | -- | -- | -- | -- | 8/7 | -- |

| D. Boral ARC Acquisition II Corp. | F-1 | D. Boral | 6/27/25 | 6/27/25 | S-1 | -- | -- | -- | -- | -- | -- | -- |

| Blueport Acquisition Ltd | S-1 | A.G.P. | 6/26/25 | 6/26/25 | S-1 | -- | 7/8 | -- | -- | -- | -- | -- |

| CSLM Digital Asset Acquisition Corp III, Ltd | S-1 | Cohen & Co. | 6/18/25 | 6/18/25 | -- | -- | 7/7 | -- | 7/22 | 7/31 | -- | 8/12 |

| BM Acquisition Corp. | S-1 | D. Boral Capital | 6/17/25 | 6/17/25 | -- | -- | -- | -- | 7/24 | -- | -- | -- |

| Kilcoy Global Foods, Ltd. | F-1 | Citigroup | 6/16/25 | -- | 6/27 | -- | -- | -- | -- | -- | -- | -- |

| Yimutian Inc. | F-1 | US Tiger | 6/9/25 | 7/22/25 | -- | -- | -- | -- | 7/22 | 7/31 | 8/5 | -- |

| Otsaw Limited | F-1 | Aegis Capital | 6/9/25 | 7/7/25 | -- | -- | 7/7 | 7/15 | 7/25 | -- | -- | -- |

| Gifts International Holdings Limited | F-1 | R. F. Lafferty | 6/6/25 | 6/6/25 | 6/27 | -- | -- | 7/18 | -- | 8/1 | -- | 8/15 |

| TryHard Holdings Limited | F-1 | US Tiger | 6/3/25 | 6/3/25 | 6/25 | -- | -- | -- | 7/21 | -- | 8/5 | 8/13 |

| Beta FinTech Holdings Limited | F-1 | Cathay Securities | 6/3/25 | 6/3/25 | 6/27 | -- | -- | 7/18 | -- | -- | -- | 8/11 |

| Crown Reserve Acquisition Corp. I | S-1 | SPAC Advisory | 5/30/25 | 5/30/25 | -- | -- | 7/11 | 7/16 | -- | 8/1 | -- | -- |

| FG Merger III Corp. | S-1 | ThinkEquity | 5/29/25 | 5/29/25 | -- | 7/1 | -- | 7/17 | -- | -- | 8/6 | -- |

| Living Homeopathy International Ltd. | F-1 | US Tiger | 5/22/25 | 5/22/25 | -- | -- | -- | -- | -- | -- | 8/8 | -- |

| Ultra High Point Holdings Limited | F-1 | Bancroft Capital | 5/20/25 | 5/20/25 | 6/27 | -- | -- | -- | -- | 8/1 | -- | -- |

| INFINT Acquisition Corporation 2 | S-1 | Roth Capital | 5/20/25 | 5/20/25 | 6/26 | -- | -- | -- | -- | -- | -- | -- |

| Uptrend Holdings Limited | F-1 | Cathay Securities | 5/19/25 | 5/19/25 | -- | -- | 7/11 | -- | 7/23 | 8/1 | -- | 8/15 |

| Fitness Champs Holdings Limited | F-1 | Bancroft Capital | 5/19/25 | 5/19/25 | -- | -- | -- | -- | -- | -- | 8/7 | -- |

| Zi Yun Dong Fang Limited | F-1 | Cathay Securities | 5/16/25 | 5/16/25 | -- | -- | -- | -- | -- | 7/28 | 8/8 | -- |

| Hang Feng Technology Innovation Co., Ltd. | F-1 | Kingswood | 5/14/25 | 5/14/25 | -- | -- | -- | -- | 7/25 | -- | -- | 8/11 |

| Charming Medical Limited | F-1 | Cathay Securities | 5/14/25 | 5/14/25 | -- | -- | -- | -- | -- | 7/30 | -- | -- |

| Platinum Analytics Cayman Limited | F-1 | Kingswood | 5/9/25 | 5/9/25 | -- | -- | -- | -- | 7/21 | -- | 8/5 | -- |

| Lake Superior Acquisition Corp. | S-1 | Cohen & Co. | 5/8/25 | 5/8/25 | -- | -- | 7/10 | -- | -- | -- | -- | -- |

| HW ELECTRO Kabushiki Kaisha | F-1 | American Trust | 5/8/25 | 5/8/25 | 6/23 | -- | -- | -- | -- | -- | -- | -- |

| StoneBridge Acquisition II Corporation | S-1 | Maxim Group | 5/5/25 | 5/5/25 | -- | -- | 7/7 | -- | -- | 8/1 | -- | -- |

| Elite Express Holding Inc. | S-1 | Dominari | 5/5/25 | 5/5/25 | -- | -- | -- | 7/14 | -- | -- | -- | 8/14 |

| TV Channels Network Inc. | S-1 | Craft Capital | 5/2/25 | 5/2/25 | -- | -- | -- | -- | -- | -- | 8/4 | -- |

| THE GROWHUB LIMITED | F-1 | Alexander Capital | 5/2/25 | 5/2/25 | -- | 7/3 | -- | -- | -- | -- | -- | 8/13 |

| MSM Frontier Capital Acquisition Corp. | S-1 | Cohen & Co. | 4/30/25 | 4/30/25 | -- | 6/30 | -- | 7/16 | -- | -- | -- | -- |

| MPJS Group Limited | F-1 | Cathay Securities | 4/30/25 | 4/30/25 | -- | -- | 7/9 | -- | -- | -- | -- | -- |

| Green Solar Energy Limited | F-1 | Joseph Stone | 4/15/25 | 4/15/25 | 6/23 | -- | 7/10 | -- | -- | -- | -- | -- |

| Timber Road Acquisition Corp. | S-1 | Roth Capital | 4/14/25 | 4/14/25 | -- | -- | -- | 7/16 | -- | -- | 8/4 | -- |

| Picard Medical, Inc. | S-1 | WestPark | 3/31/25 | 7/11/25 | -- | -- | 7/11 | 7/18 | -- | 7/30 | 8/6 | -- |

| Gameverse Interactive Corp. | S-1 | [To be named] | 3/24/25 | 3/24/25 | -- | -- | -- | 7/16 | -- | -- | -- | -- |

| StubHub Holdings, Inc. | S-1 | JPMorgan | 3/21/25 | -- | -- | -- | -- | -- | -- | -- | -- | 8/11 |

| Spectral IP, Inc. | S-1 | Pacific Century | 3/20/25 | 6/5/25 | -- | 7/3 | -- | -- | -- | -- | -- | -- |

| Xinzi | F-1 | Revere Securities | 3/19/25 | 3/19/25 | -- | 6/30 | -- | -- | -- | -- | 8/8 | -- |

| Jingrui Wang Pu Holdings Group Ltd. | F-1 | Eddid Securities | 3/17/25 | 3/17/25 | -- | -- | -- | -- | -- | -- | -- | 8/15 |

| Klarna Group plc | F-1 | Goldman Sachs | 3/14/25 | -- | -- | -- | -- | -- | -- | -- | -- | 8/14 |

| POMDOCTOR LIMITED | F-1 | Joseph Stone | 3/13/25 | 7/15/25 | -- | -- | -- | 7/15 | -- | -- | 8/5 | -- |

| Regentis Biomaterials Ltd. | F-1 | ThinkEquity | 3/10/25 | 3/10/25 | -- | -- | 7/7 | -- | -- | -- | -- | -- |

| ELC Group Holdings Ltd. | F-1 | D. Boral Capital | 3/4/25 | 6/27/25 | 6/27 | -- | 7/9 | -- | 7/25 | -- | 8/7 | -- |

| DT House Limited | F-1 | American Trust | 2/28/25 | 2/28/25 | -- | -- | -- | -- | -- | -- | 8/6 | -- |

| BGIN BLOCKCHAIN LIMITED | F-1 | D. Boral Capital | 2/21/25 | 3/20/25 | -- | -- | -- | -- | -- | 7/31 | -- | -- |

| Rainbow Capital Holdings Limited | F-1 | Cathay Securities | 2/14/25 | 2/14/25 | 6/26 | -- | 7/8 | -- | -- | -- | 8/4 | -- |

| Harvard Ave Acquisition Corporation | S-1 | D. Boral Capital | 2/11/25 | 2/11/25 | -- | -- | -- | 7/15 | -- | -- | -- | -- |

| AMBITIONS ENTERPRISE MANAGEMENT CO. | F-1 | AC Sunshine | 2/7/25 | 7/18/25 | 6/27 | -- | -- | 7/18 | -- | 8/1 | -- | -- |

| Vistek Limited | F-1 | Bancroft Capital | 1/28/25 | 1/28/25 | -- | -- | -- | -- | -- | 7/31 | -- | -- |

| Softto, Inc. | F-1 | Revere Securities | 1/24/25 | 1/24/25 | -- | 7/2 | -- | -- | -- | -- | -- | -- |

| One and one Green Technologies. INC | F-1 | Cathay Securities | 1/21/25 | 6/6/25 | -- | -- | 7/10 | -- | -- | -- | -- | -- |

| Iron Horse Acquisitions Corp. II | S-1 | Cantor | 1/17/25 | 1/17/25 | 6/23 | 7/3 | -- | -- | -- | -- | 8/6 | -- |

| Agroz Inc. | F-1 | US Tiger | 1/16/25 | 1/16/25 | -- | 7/1 | -- | 7/16 | -- | -- | 8/4 | -- |

| Antharas Inc | F-1 | D. Boral Capital | 1/15/25 | 1/15/25 | -- | 7/1 | -- | -- | -- | 8/1 | -- | -- |

| Zenta Group Company Limited | F-1 | Cathay Securities | 1/6/25 | 1/6/25 | 6/24 | -- | -- | -- | 7/24 | -- | 8/7 | -- |

| Phaos Technology Holdings (Cayman) Ltd. | F-1 | Network 1 | 1/3/25 | 1/3/25 | -- | -- | 7/7 | -- | 7/25 | -- | -- | -- |

| LEIFRAS Co., Ltd. | F-1 | Kingswood | 12/10/24 | 12/10/24 | -- | 7/2 | -- | -- | -- | -- | -- | -- |

| Papa Medical Inc. | S-1 | US Tiger | 11/22/24 | 6/27/25 | 6/27 | -- | -- | 7/14 | -- | -- | 8/7 | -- |

| GLAMOORE Capital Group Company Limited | F-1 | Eddid Securities | 11/12/24 | 11/12/24 | -- | -- | -- | 7/14 | -- | -- | -- | -- |

| Transten Global Group Limited | F-1 | US Tiger | 10/29/24 | -- | -- | -- | -- | -- | -- | 7/30 | -- | -- |

| Curanex Pharmaceuticals Inc | S-1 | Dominari | 10/16/24 | 10/16/24 | -- | 7/1 | -- | 7/18 | -- | -- | -- | -- |

| Eastern International Ltd. | F-1 | Maxim Group | 9/3/24 | 9/3/24 | -- | -- | -- | 7/18 | -- | -- | -- | -- |

| Thoughtful Media Group Inc. | S-1 | Cathay Securities | 8/15/24 | 8/15/24 | -- | -- | 7/11 | 7/18 | -- | -- | -- | -- |

| Texxon Holding Limited | F-1 | D. Boral Capital | 8/13/24 | 3/31/25 | -- | -- | -- | 7/17 | -- | -- | 8/8 | 8/14 |

| Megan Holdings Limited | F-1 | D. Boral Capital | 8/8/24 | 8/8/24 | -- | -- | -- | 7/17 | -- | 8/1 | -- | -- |

| Lannister Mining Corp. | F-1 | Joseph Gunnar | 7/31/24 | 5/2/25 | -- | -- | -- | -- | -- | -- | 8/5 | -- |

| AEI CapForce II Investment Corp | S-1 | R.F. Lafferty | 7/30/24 | 7/30/24 | -- | -- | -- | -- | -- | -- | 8/7 | -- |

| Calisa Acquisition Corp | S-1 | EarlyBirdCapital | 6/28/24 | 6/28/24 | -- | -- | 7/7 | -- | -- | -- | -- | -- |

| Xinxu Copper Industry Technology Limited | F-1 | Craft Capital | 3/29/24 | 8/4/25 | -- | -- | -- | -- | -- | -- | 8/4 | -- |

| Libera Gaming Operations, Inc. | F-1 | D. Boral Capital | 3/15/24 | 3/15/24 | -- | -- | 7/7 | -- | -- | -- | -- | -- |

| BRB Foods Inc. | S-1 | Alexander Capital | 1/17/24 | 6/3/24 | -- | 7/1 | -- | 7/16 | -- | -- | 8/4;8/6 | -- |

| Going International Holding Company Limited | F-1 | Prime Number | 12/15/23 | -- | -- | -- | -- | -- | 7/22 | -- | -- | -- |

| Hengguang Holding Co., Limited | F-1 | D. Boral Capital | 1/18/22 | 3/30/22 | -- | -- | 7/8 | -- | -- | -- | -- | -- |

| ALE Group Holding Limited | F-1 | D. Boral Capital | 7/28/21 | 7/28/21 | 6/23 | -- | -- | -- | -- | -- | -- | -- |

IPO Line-Up includes all IPO registrants that have filed to go public in the U.S., have neither gone public nor formally withdrawn their offering by filing a Form RW with the SEC, and have had filing activity in the most recent eight week period. IPO Line-Up includes all SEC registered IPOs, including REITs and those non-U.S. IPO filers seeking to list in the U.S. markets, except for 1) closed-end funds; 2) best-efforts, self-underwritten, and direct offerings; and 3) small business IPOs with an offering amount of less than $5 million. IPO Line-Up: Recent SEC IPO Filing Activity is based on information provided from the IPO Vital Signs System located at www.rbsourcefilings.com