The IPO Week

One IPO

Big Rock Partners Acquisition Completes Lone IPO In Week as Market Slows for the Holiday

Issuer Raises $60 Million to Pursue an Acquisition In the U.S. Senior Housing and Care Industry

One Initial IPO Filing

Industrial Logistics Properties Trust Is Second REIT New Registrant In As Many Weeks, Tenth of 2017

Industrial Logistics Was Formed Recently to Own and Lease Industrial and Logistics Properties Throughout the U.S.

REIT's Owner, Select Income REIT, Contributed Properties In Exchange for 45 Million Shares and a $750 Million Demand Note

One IPO Withdrawal

May 2016 Registrant Highland Acquisition Chooses Not Proceed with IPO at This Time

| IPO Offerings | Form Type |

1st Lead Manager

Listed |

Initial Filing Date | Offer Date |

|---|---|---|---|---|

| Big Rock Partners Acquisition Corp. | 424B4 | EarlyBirdCapital, Inc. | 10/13/17 | 11/20/17 |

| Initial IPO Filings | Form Type | 1st Lead Manager

Listed |

Initial Filing Date | |

|---|---|---|---|---|

| Industrial Logistics Properties Trust | S-11 | UBS Securities LLC | 11/21/17 |

| IPO Withdrawals | Form Type | 1st Lead Manager

Listed |

Initial Filing Date | Withdrawal Date |

|---|---|---|---|---|

| Highland Acquisition Corporation | RW | Ladenburg Thalmann & Co. Inc. | 5/23/16 | 11/20/17 |

IPO Vital Sign of the Month

#336 - Countries of IPO Incorporation

Use IPO Vital Sign #336 to…

- Review the number and percentage of companies going public from each country of incorporation.

- Analyze trends over time.

- Identify characteristics of IPO companies incorporated in different countries.

IPO Vital Sign Tips & Tricks

Click on the blue numbers to drill down for more information. Once in the drill down, click column headings to sort the data in an order more useful for answering your questions.

IPO News Desk

Price Cuts: Pricing Weakness Spreads Among November IPOs

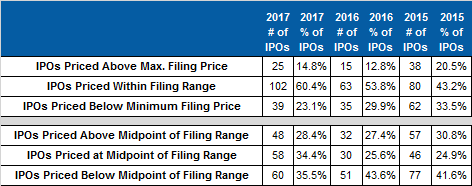

Stitch Fix made its public market debut recently at $15 per share, $3 below the bottom of its published price range of $18 to $20 per share. The price cut was widely attributed to lower demand due to the relatively poor performance of high-profile technology IPOs like Blue Apron and Snap. However, a closer look at November’s deals shows that pricing weakness spread beyond just high-tech deals.

By November’s midpoint, six of the month’s 19 completed offerings had priced below the minimum filing price range, with each of those six issuers representing a different industry. November’s total is double the number of deals that priced below their stated range in each of September and October. Prior to November, May had seen the greatest IPO pricing instability with seven out of 21 new issues selling below the initial range.

Recent pricing difficulties are an exception in 2017, which so far has seen the lowest level of IPOs priced below the minimum filing price in a decade. Even with the recent increase, only 23% of deals completed between January 1st and November 15th had to sell below the intended range. That compares to 29.9% in 2016 and 33.5% in 2015. The closest any recent year has come to 2017’s 23% is 2009 when 25% of offerings priced below the minimum filed range. In the last decade, 2012 saw the largest percentage with 39% of that year’s 141 new issues priced below the minimum filing price.

The 2017 IPO company that slashed its offer price the most is YogaWorks. The company filed a price range of $12 to $14, but priced at $5.50 per share, a 57.7% drop from the midpoint of the initial range. Three other new issuers have priced 50% or more below the midpoint of the filing range. Immuron reduced its price by 52.4%, Calyxt by 51.5% and Elevate Credit by 50%.

The bulk of 2017’s new issues (just over 60%) have priced within the filing range. The year is on pace to exceed both 2015 and 2016, which finished with 53.8% and 43.2%, respectively, of IPOs priced within the filling range. Through November 15th, 14.8% of 2017’s IPOs have priced above the range, which is better than 2016’s 12.8% but lags behind 2015’s 20.5%.

Final IPO Pricing

v.

Initial

Filing Range

2015 Through November 2017*

(* Data through November 15, 2017)

IPO

Vital Signs Subscribers see,

#446. Final Pricing v. Initial

Filing Price Range.

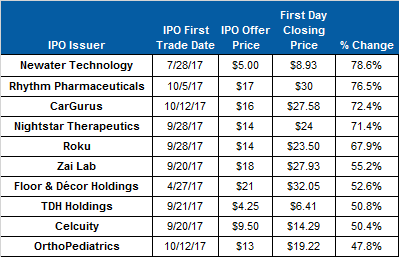

First Day Movement - In

general, IPOs completed between January 1st and

November 15th started off well, with 93 new

issues gaining at least 1% in value on their first trading

day. Seven of the year’s IPO companies saw their shares remain

flat on initial trading day, while the shares of 33 issuers lost

value on the first day.

The top first-day gainer in 2017 is

Newater Technology, whose shares jumped 78.6%

on their first trading day. Rhythm Pharmaceuticals

posted the second largest gain by climbing 76.5% from $17 to $30

on its initial trading day. At +72.4%, CarGurus

enjoyed the third largest first-day gain of the year so far. In

all, nine issuers saw their shares rise 50% or more on their

first day.

Companies whose shares dropped in value on the initial trading day have not fared too badly, with only 12 falling 10% or more. The largest first-day loss was a 41.4% drop by Funko on November 1st. Allena Pharmaceuticals’ shares dropped 28.7% on their initial trading day, while shares of Aileron Therapeutics fell 28%.

2017 Top Ten IPO First Day Pricing

Gains

(IPOs First Trading from 1/1/17 to 11/20/17*)

(* Data through November 20, 2017)

IPO

Vital Signs Subscribers see,

#290. IPO First Day Pricing

Statistics.

Post First-Day Performance - Since its impressive first-day gain, Newater Technology has continued to climb, posting a 98.2% gain through November 21st. The year’s top performing IPO through that date is AnaptysBio, whose shares have risen 428.2%. Seven other companies’ shares have more than doubled in value, led by SMART Global Holdings (+232.1%) and UroGen Pharma (+214.7%). Overall, 84 companies that have made their market debuts this year have increased at least 1% in value since they began trading.

Despite getting off to the second fastest start of the year, shares of Rhythm Pharmaceuticals have slid backwards in subsequent trading. After a 76.5% first-day gain, Rhythm’s shares traded 64.1% above the IPO price as of November 21st. On the other side of the spectrum is G1 Therapeutics, whose shares finished their first day (May 17th) with no gain, but as of November 21st had risen 35% above their debut price.

Of the industries that have produced at least

five IPO companies in 2017, pharmaceutical preparations (SIC

2834) has turned in the best aftermarket performance as a group.

The sector is up 31.5% as a whole so far this year. Although

some software companies have struggled, as a group prepackaged

software (SIC 7372) shares are up 29.6% as of November 21st.

The IPO Line-Up

IPO Line-Up Rises One to 38 Eight-Week Active Registrants

April Registrant Vine Resources Rejoins IPO Line-Up with First Filing Since May 5th

No Initial Price Ranges Filed

First Time Since Mid-August That No Initial Price Ranges Have Been Filed In a Week

Nine Other Registrants File Amendments

Adial Pharmaceuticals Changes First Lead Manager from Aegis Capital to Joseph Gunnar In Latest Filing

Hong Kong-Based iClick Interactive Asia Group Replaces Lead Manager Credit Suisse with Network 1 Financial

Leisure Acquisition and Regalwood Global Energy Have Been Active In Consecutive Weeks

Four New Registrants Amend Their Filings for the First Time:

LexinFintech Holdings, Entera Bio, Senmiao Technology and Newmark Group

IPO Line-Up

(Ranked by Initial Filing Date)

The IPO Line-Up contains IPO Registrants that have had filing activity in the last 8 weeks

and have not gone public or withdrawn from registration.

IPO Registrants that are red and bold indicate that a filing with the initial IPO price range has been filed with the SEC.

| IPO Registrant | Form Type | 1st Lead Mgr Listed | Initial Filing Date | Filing w/ Initial Price Range | 10/2 - 10/6 | 10/9 - 10/13 | 10/16 - 10/20 | 10/23 - 10/27 | 10/30 - 11/3 | 11/6 - 11/10 | 11/13 - 11/17 | 11/20 - 11/24 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Industrial Logistics Properties Trust | S-11 | UBS | 11/21/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-11 |

| Casa Systems, Inc. | S-1 | Morgan Stanley | 11/17/17 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Advantage Insurance Inc. | S-1 | Raymond James | 11/16/17 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| GigCapital, Inc. | S-1 | Cowen | 11/15/17 | 11/15/17 | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Hudson Ltd. | F-1 | Credit Suisse | 11/14/17 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| FARMMI, Inc. | F-1 | ViewTrade | 11/14/17 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| Camposol Holding Plc | F-1 | BofA Merrill Lynch | 11/14/17 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| Americold Realty Trust | S-11 | BofA Merrill Lynch | 11/14/17 | -- | -- | -- | -- | -- | -- | -- | S-11 | -- |

| TFI TAB Gida Yatirimlari A.S. | F-1 | Morgan Stanley | 11/13/17 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| Odonate Therapeutics, LLC | S-1 | Goldman Sachs | 11/13/17 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| LexinFintech Holdings Ltd. | F-1 | Goldman Sachs | 11/13/17 | -- | -- | -- | -- | -- | -- | -- | F-1 | 11/20 |

| Denali Therapeutics Inc. | S-1 | Goldman Sachs | 11/13/07 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| AXA Equitable Holdings, Inc. | S-1 | Morgan Stanley | 11/13/17 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Quanterix Corporation | S-1 | JPMorgan | 11/9/17 | -- | -- | -- | -- | -- | -- | S-1 | -- | -- |

| Luther Burbank Corporation | S-1 | Keefe Bruyette | 11/9/17 | -- | -- | -- | -- | -- | -- | S-1 | -- | -- |

| Entera Bio Ltd. | F-1 | Oppenheimer | 11/9/17 | -- | -- | -- | -- | -- | -- | F-1 | -- | 11/20 |

| Leisure Acquisition Corp. | S-1 | Morgan Stanley | 11/3/17 | 11/3/17 | -- | -- | -- | -- | S-1 | -- | 11/16 | 11/24 |

| Senmiao Technology Limited | S-1 | ViewTrade | 10/30/17 | -- | -- | -- | -- | -- | S-1 | -- | -- | 11/22 |

| Insurance Income Strategies Ltd. | S-1 | Joseph Gunnar | 10/24/17 | -- | -- | -- | -- | S-1;10/27 | -- | -- | -- | -- |

| Newmark Group, Inc. | S-1 | Goldman Sachs | 10/23/17 | -- | -- | -- | -- | S-1 | -- | -- | -- | 11/20 |

| CURO Group Holdings Corp. | S-1 | Credit Suisse | 10/23/17 | -- | -- | -- | -- | S-1 | 11/1 | 11/6 | -- | -- |

| iClick Interactive Asia Group Limited | F-1 | Network 1 | 10/20/17 | -- | -- | -- | F-1 | -- | -- | -- | -- | 11/22 |

| WatchGuard, Inc. | S-1 | Barclays | 10/19/17 | -- | -- | -- | S-1 | -- | -- | -- | -- | -- |

| Workspace Property Trust | S-11 | Goldman Sachs | 10/13/17 | 10/31/17 | -- | S-11 | 10/19 | 10/27 | 10/31;11/3 | 11/9 | -- | -- |

| One Madison Corporation | S-1 | Credit Suisse | 10/13/17 | 10/13/17 | -- | S-1 | -- | -- | -- | -- | -- | -- |

| Regalwood Global Energy Ltd. | S-1 | Citigroup | 10/2/17 | 10/2/17 | S-1 | -- | -- | -- | 11/3 | -- | 11/16 | 11/24 |

| Howard Midstream Partners, LP | S-1 | Barclays | 9/12/17 | -- | -- | -- | 10/18 | -- | -- | -- | -- | 11/21 |

| Molino Canuelas S.A.C.I.F.I.A. | F-1 | JPMorgan | 9/8/17 | 11/6/17 | -- | -- | 10/19 | -- | -- | 11/6 | -- | -- |

| Hancock Jaffe Laboratories, Inc. | S-1 | WallachBeth | 9/7/17 | 11/6/17 | -- | -- | -- | -- | -- | 11/6 | -- | -- |

| Adial Pharmaceuticals, Inc. | S-1 | Joseph Gunnar | 9/6/17 | 9/6/17 | -- | -- | -- | 10/25 | -- | -- | -- | 11/22 |

| ReTo Eco-Solutions, Inc. | F-1 | ViewTrade | 8/4/17 | 8/4/17 | -- | 10/13 | -- | -- | -- | -- | 11/13 | -- |

| ProLung, Inc. | S-1 | Maxim Group | 8/4/17 | 10/17/17 | -- | -- | 10/17 | -- | -- | -- | -- | -- |

| LiveXLive Media, Inc. | S-1 | BMO | 5/11/17 | 10/6/17 | 10/6 | -- | 10/16 | -- | -- | -- | -- | -- |

| Nine Energy Service, Inc. | S-1 | JPMorgan | 5/2/17 | -- | -- | -- | -- | -- | -- | -- | 11/13 | -- |

| Vine Resources Inc. | S-1 | Credit Suisse | 4/10/17 | -- | -- | -- | -- | -- | -- | -- | -- | 11/21 |

| Liberty Oilfield Services Inc. | S-1 | Morgan Stanley | 2/14/17 | -- | -- | -- | -- | -- | -- | 11/9 | -- | -- |

| FTS International, Inc. | S-1 | Credit Suisse | 2/10/17 | -- | -- | -- | -- | -- | 10/30 | -- | -- | -- |

| Albertsons Companies, Inc. | S-1 | Goldman Sachs | 7/8/15 | -- | -- | -- | -- | -- | -- | 11/8 | -- | -- |

IPO Line-Up includes all IPO registrants that have filed to go public in the U.S., have neither gone public nor formally withdrawn their offering by filing a Form RW with the SEC, and have had filing activity in the most recent eight week period. IPO Line-Up includes all SEC registered IPOs, including REITs and those non-U.S. IPO filers seeking to list in the U.S. markets, except for 1) closed-end funds; 2) best-efforts, self-underwritten, and direct offerings; and 3) small business IPOs with an offering amount of less than $5 million. IPO Line-Up: Recent SEC IPO Filing Activity is based on information provided from the IPO Vital Signs System located at https://www.ipovitalsigns.com/