The IPO Week

Two IPOs

Silver Run Acquisition Corp. II's $900 Million Offering Is 2017's Third Largest IPO

Texas Company Is March's Second Blank Checks New Issuer, Fourth of the Year

Alteryx Completes Second Deal by a Prepackaged Software Company In as Many Weeks

Company Raised $126 Million for the Development of Self-Service Data Analytics Software

Three Initial IPO Filings

Forum Merger Plans $125 Million Offering with EarlyBirdCapital as Lead Manager

Blank Checks Company Is Seeking U.S. Target with Enterprise Value of At Least $250 Million

Forum's Sponsor Recently Bought 3.6 Million Class F Shares That Will Convert to Class A Shares When Target Is Acquired

Colorado-Based Cable Operator WideOpenWest Registers

Company Provides High-Speed Data, Cable TV and VOIP Telephony Under WOW! Brand Name

Following IPO, WideOpenWest Will Continue to be Controlled by PE Firms Avista Capital Partners and Crestview Partners

Roth Capital Will Lead Deal by ASV Holdings, Maker of Compact Track Loader and Skid Steer Loader Equipment

Company Will Convert from a Minnesota LLC to a Delaware Corporation In Connection with the IPO

One Minnesota-Headquartered Company Has Completed an IPO In U.S. Markets In Each of the Past Two Years

One IPO Withdrawal

Lumena Pharmaceuticals Is Acquired by Shire plc, Calls Off Planned IPO

April 2014 Filer Never Amended Its Registration Statement

| IPO Offerings | Form Type | Initial Filing Date | Offer Date | |

|---|---|---|---|---|

| Alteryx, Inc. | 424B4 | Goldman, Sachs & Co. | 2/24/17 | 3/23/17 |

| Silver Run Acquisition Corporation II | 424B4 | Citigroup Global Markets Inc. | 3/2/17 | 3/23/17 |

| Initial IPO Filings | Form Type | 1st Lead Manager

Listed |

Initial Filing Date | |

|---|---|---|---|---|

| Forum Merger Corporation | S-1 | EarlyBirdCapital, Inc. | 3/20/17 | |

| WideOpenWest, Inc. | S-1 | UBS Securities LLC | 3/23/17 | |

| ASV Holdings, Inc. | S-1 | Roth Capital Partners, LLC | 3/24/17 |

| IPO Withdrawals | Form Type | 1st Lead Manager

Listed |

Initial Filing Date | Withdrawal Date |

|---|---|---|---|---|

| Lumena Pharmaceuticals, Inc. | RW | Citigroup Global Markets Inc. | 4/2/14 | 3/20/17 |

IPO Vital Sign of the Month

#1000 - IPO Filings

An interactive table that lists every company to file an initial public IPO registration statement.

Use IPO Vital Sign #1000 to...

- Locate comparable IPO issuers by SIC code, lead manager, issuer's law firm, etc.

- Analyze IPO professional activity in terms of number of IPOs filed

IPO Vital Sign Tips & Tricks

Change the date range by clicking on [For the period] in the upper left hand corner of the IPO Vital Sign. Use the drop down boxes to select new Start and End Dates. Click the [REFRESH] button to obtain the new date range’s data.

IPO News Desk

IPO Experts Speak: Sizing Up 2017's IPO Market

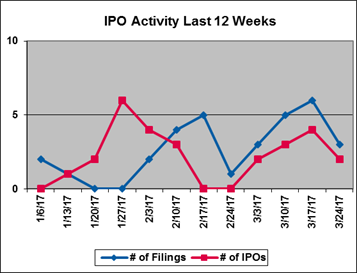

The IPO market is off to a reassuring start in 2017 after posting a 37% drop in deals in 2016 with the lowest IPO totals since the financial crisis. With one week left in the first quarter, 27 deals have been completed this year. Only 11 IPOs were completed in the first three months of 2016. New registrations are also slightly outpacing last year with 32 new registrations compared to 25 during the same period in 2016.

2017's early momentum includes the successful $3.4 billion debut of Snapchat developer Snap Inc., and a surge in new registrations from the energy industry. The positive attention generated by Snap and other recent new issues has helped, as has greater stability in world markets. However, it is unclear how the market will respond as the new presidential administration moves forward with its aggressive agenda. It also remains to be seen if a robust M&A market and the ready availability of private financing will cut into IPO totals as they did in 2016. We asked Marc Jaffe, a partner with Latham & Watkins, to discuss the state of the market at the moment and what the rest of 2017 might bring for IPOs.

Marc Jaffe, a partner in the New York

office of Latham & Watkins, is the global Chair

of the Corporate Department and former global Co-chair of the

firm’s Capital Markets Practice. His practice centers on

corporate finance and general securities and corporate matters.

His clients include US and foreign investment banks, New York

Stock Exchange and Nasdaq-listed companies, non-US corporations,

private equity funds and mezzanine investment funds. Mr. Jaffe

has substantial experience representing issuers, investment

banking firms and investors in public and private debt and

equity offerings and lending transactions of all kinds in

several industries. He has also represented investment banks,

companies and investors in exchange offers, tender offers and

consent solicitations, restructurings, bridge lending and loan

commitments and other financing transactions. Mr. Jaffe was

recognized in The American Lawyer’s “Dealmakers of the Year”

issue for his leadership of Manchester United’s 2012 IPO on the

New York Stock Exchange. He was also ranked as one of the

leading capital markets lawyers by each of Chambers Global,

Chambers USA, IFLR1000 and The Legal 500, and recognized by The

Legal 500 Latin America.

IPO Vital Signs: In 2016, the IPO market had its slowest year since the financial crisis with a 37% drop in deals from 2015’s total. The M&A market was robust last year, which cut down on the number of new issues. What will it take to get the IPO market moving again?

Marc Jaffe: While market volatility and the uncertainty surrounding the US election and Brexit weighed on US IPO activity in 2016, strong equity market performance, increasing market stability in Europe and the publicized success of recent IPOs are elements contributing to an uptick in IPO activity and outlook in 2017. Many of the deals that were largely teed up but not executed last year have come to market or are soon to come to market, and we anticipate more activity in the second and third quarters of 2017 given the significant backlog. The relative success of recent high profile IPOs is also clearly enticing issuers to gear up to go to market in the second half of this year. The strong IPO pipeline representing a range of industries coupled with a stabilized geopolitical environment could indicate a healthier IPO market in 2017.

IPOVS: Companies are staying private longer, and there are more companies than ever before with $1 billion+ in market cap that have stayed private. What are some of the factors behind this trend? Is the pressure building for well-capitalized private companies such as Uber and AirBnB to go public?

Mr. Jaffe: More flexible securities laws like the JOBS Act, Reg A+ and the abundance of private capital have made it easier for companies to stay well-funded and private longer. The private market has strengthened with regard to secondary liquidity and continues to attract institutional investors seeking growth equity returns. While certainly investors in well-capitalized private companies, particularly the venture capital firms, will want to see a return to their investors over time, I do not believe they are feeling pressure to go public in the near-term given that many of these businesses continue to show tremendous growth (even if they are not yet making money). With certain of these billion dollar plus market cap private companies there are fundamental regulatory and market questions that need to be resolved before they can tell their best go-to-market story.

IPOVS: There has been a lot of press lately about deals where the issuer keeps voting control by maintaining dual classes of common shares. If a client approached you that wanted to execute this kind of offering, what would you counsel them to keep in mind regarding the benefits and risks of the dual class structure?

Mr. Jaffe: The benefits of a dual-class structure are often seen when a company is strongly identified with the founders, or a family has controlled the company for a long period of time. Markets are typically more receptive to a dual-class structure in these scenarios because having the founders or family involved is seen as a benefit to the value of the company. The dual-class structure allows holders of the high vote class of shares to maintain voting control even as their economic interest falls proportionally lower. Within certain time and minimum economic holding parameters, the market seems to be largely receptive, where a story about the value of continued control is compelling, to the weighted voting afforded those founders. Founders often have a longer term vision for the companies they started, and an IPO issuer can benefit by locking those persons’ control in.

There can be market pressure against such structures where investors do not see the value of entrenched managers or guaranteed board control. There is clearly a large element of trust that investors must sign up to share. Dual class structures that vary from what the market sees as current norm for high vote/low vote splits, rights and fall-away provisions press that trust and can have marketing implications.

IPOVS: The pharmaceutical industry dominated the market for the fourth straight year in 2016, but is off to a relatively slow start in 2017 with only one preliminary registration to date. Are there any particular industries that you believe will perform well in 2017?

Mr. Jaffe: While robust deal activity across sectors is expected in 2017, technology, consumer retail, industrials and energy companies in particular are poised to perform well. Restaurant IPOs could again be popular as a stronger economy drives consumers to dine out, and the fast-casual industry’s emphasis on healthy options attracts more customers.

I believe that foreign private issuers across a range of industries will continue to seek opportunities to raise equity capital in the US, as the US capital markets remain the most robust and liquid of the global markets.

IPOVS: What do you foresee for the remainder of the year for IPOs? What factors will contribute to, or detract from, the new issues market for the rest of 2017?

Mr. Jaffe: The strong equity markets are driving an increase in sponsor-backed equity deals, as private equity firms are looking at an IPO as a potentially high-value exit route. The trend toward using a dual-track process also is likely to continue, particularly for private equity and venture capital-backed companies, because it offers sellers a number of advantages in their search for liquidity and maximum value. It certainly allows sellers to preserve optionality as they evaluate the attractiveness of multiple exit (or partial exit) options while hedging against IPO market volatility and overall deal uncertainty.

As Washington and the business community are intensely focused on tax reform in 2017, there is a high expectation that some form of tax reform will become a reality in the near term. The proposed reforms would impact the factors issuers consider when they determine where to raise capital and whether to do so by issuing debt or equity, and we are watching these key transactional considerations closely.

A slowdown or pause in what has been a “hot” stock market since the US election could pose a challenge for IPOs. Whenever there is a resetting of market dynamics, there is typically a pause in IPO activity because the market has a more difficult time valuing a company.

Overall, with a robust IPO pipeline, calmer geopolitical

environment, and markets at record highs, the prospects for IPOs

in 2017 are strong.

The IPO Line-Up

IPO Line-Up Falls Two to 28 Eight-Week Active Registrants

Two Initial Price Ranges Filed

Forum Merger Sets Price Range In Its Initial Public Registration

Amendment No. 3 by Schneider National Includes Price Range

Five Other Registrants File Amendments

Five Registrants Amend Filings for the First Time:

Okta, Modern Media Acquisition, Select Energy Services, Vantage Energy Acquisition and Floor & Decor Holdings

IPO Line-Up

(Ranked by Initial Filing Date)

The IPO Line-Up contains IPO Registrants that have had filing activity in the last 8 weeks

and have not gone public or withdrawn from registration.

IPO Registrants that are red and bold indicate that a filing with the initial IPO price range has been filed with the SEC.

| IPO Registrant | Form Type | 1st Lead Mgr Listed | Initial Filing Date | Filing w/ Initial Price Range | 1/30 - 2/3 | 2/6 - 2/10 | 2/13 - 2/17 | 2/20 - 2/24 | 2/27 - 3/3 | 3/6 - 3/10 | 3/13 - 3/17 | 3/20 - 3/24 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ASV Holdings, Inc. | S-1 | Roth Capital | 3/24/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| WideOpenWest, Inc. | S-1 | UBS | 3/23/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Forum Merger Corporation | S-1 | EarlyBirdCapital | 3/20/17 | 3/20/17 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Cadence Bancorporation | S-1 | Goldman Sachs | 3/17/17 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Veritone, Inc. | S-1 | Wunderlich | 3/15/17 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Solaris Oilfield Infrastructure, Inc. | S-1 | Credit Suisse | 3/15/17 | -- | -- | -- | -- | -- | -- | -- | S-1 | -- |

| Netshoes (Cayman) Limited | F-1 | Goldman Sachs | 3/15/17 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| Yext, Inc. | S-1 | Morgan Stanley | 3/13/17 | -- | -- | -- | -- | -- | -- | -- | S-1;3/17 | -- |

| Okta, Inc. | S-1 | Goldman Sachs | 3/131/7 | -- | -- | -- | -- | -- | -- | -- | S-1 | 3/20 |

| Tocagen Inc. | S-1 | Leerink | 3/9/17 | -- | -- | -- | -- | -- | -- | S-1 | -- | -- |

| NCS Multistage Holdings, Inc. | S-1 | Credit Suisse | 3/9/17 | -- | -- | -- | -- | -- | -- | S-1 | -- | -- |

| Modern Media Acquisition Corp. | S-1 | Macquarie Capital | 3/8/17 | 3/8/17 | -- | -- | -- | -- | -- | S-1 | -- | 3/24 |

| Warrior Met Coal, Inc. | S-1 | Credit Suisse | 3/7/17 | -- | -- | -- | -- | -- | -- | S-1 | -- | -- |

| Kayne Anderson Acquisition Corp. | S-1 | Citigroup | 3/7/17 | 3/7/17 | -- | -- | -- | -- | -- | S-1 | 3/16 | -- |

| Select Energy Services, Inc. | S-1 | Credit Suisse | 3/2/17 | -- | -- | -- | -- | -- | S-1 | -- | -- | 3/20 |

| Gardner Denver Holdings, Inc. | S-1 | KKR | 2/28/17 | -- | -- | -- | -- | -- | S-1 | -- | -- | -- |

| Vantage Energy Acquisition Corp. | S-1 | Citigroup | 2/17/17 | 2/17/17 | -- | -- | S-1 | -- | -- | -- | -- | 3/20 |

| Liberty Oilfield Services Inc. | S-1 | Morgan Stanley | 2/14/17 | -- | -- | -- | S-1 | -- | -- | 3/10 | -- | -- |

| FTS International, Inc. | S-1 | Credit Suisse | 2/10/17 | -- | -- | S-1 | -- | -- | 2/28 | -- | -- | -- |

| Floor & Decor Holdings, Inc. | S-1 | BofA Merrill Lynch | 2/10/17 | -- | -- | S-1 | -- | -- | -- | -- | -- | 3/20 |

| Schneider National, Inc. | S-1 | Morgan Stanley | 12/22/16 | 3/24/17 | 2/3 | -- | -- | -- | -- | 3/6 | -- | 3/24 |

| Kleopatra Holdings 2 S.C.A. | S-1 | Citigroup | 12/21/16 | -- | -- | 2/9 | -- | -- | -- | -- | -- | -- |

| Immuron Limited | F-1 | Joseph Gunnar | 12/21/16 | -- | -- | 2/9 | -- | -- | -- | -- | -- | -- |

| Frankly Inc. | S-1 | Roth Capital | 11/10/16 | -- | 2/1 | -- | -- | -- | -- | -- | -- | -- |

| Mota Group, Inc. | S-1 | Joseph Gunnar | 10/5/16 | -- | -- | 2/10 | -- | -- | -- | -- | -- | -- |

| Elevate Credit, Inc. | S-1 | UBS | 11/9/15 | -- | 1/30 | -- | -- | -- | -- | 3/10 | -- | -- |

| Intrepid Aviation Limited | S-1 | Goldman Sachs | 11/12/14 | -- | -- | 2/10 | -- | -- | -- | -- | -- | -- |

| Hess Midstream Partners LP | S-1 | Goldman Sachs | 9/24/14 | -- | -- | -- | 2/13 | -- | -- | -- | 3/16 | -- |

IPO Line-Up includes all IPO registrants that have filed to go public in the U.S., have neither gone public nor formally withdrawn their offering by filing a Form RW with the SEC, and have had filing activity in the most recent eight week period. IPO Line-Up includes all SEC registered IPOs, including REITs and those non-U.S. IPO filers seeking to list in the U.S. markets, except for 1) closed-end funds; 2) best-efforts, self-underwritten, and direct offerings; and 3)small business IPOs with an offering amount of less than $5 million. IPO Line-Up: Recent SEC IPO Filing Activity is based on information provided from the IPO Vital Signs System located at https://www.ipovitalsigns.com/