The IPO Week

Six IPOs

Following Three New Offerings, Blank Checks Leads All Industries with 14 IPOs In 2017

Bison Capital Acquisition, Which Operates Out of Beijing, Raises $52.5 Million In Its Debut

Company Seeks an Asian or North American Target In Media/Entertainment, Consumer Services or Healthcare Industries

Hennessy Capital Acquisition Corp. III Is the First Wyoming-Headquartered Company to Go Public In the U.S. Since November 2009

Hennessy Is Looking to Acquire an Industrial Manufacturing Company with an Enterprise Value Over $1 Billion

Cowen’s Sixth IPO as Lead Manager This Year Is $125 Million Deal for Constellation Alpha Capital

Constellation Alpha, Like Bison Capital, Is Incorporated In the British Virgin Islands

Altice USA’s $1.9 Billion Offering Is Year’s Second Largest IPO Behind Snap’s $3.4 Billion Deal

SIC 4841 (Cable & Other Pay Television Svcs.) Has Produced Two New Issuers In 2017 After None In the Prior 15 Years

Safety, Income & Growth, New York-Based Purchaser and Owner of Ground Net Leases, Is Publicly Traded

Saftey's Deal Is One of Only Two SIC 6519 (Lessors of Real Property) IPOs In the Past Ten Years

Fifth REIT IPO of the Year Is Completed by New York-Based Granite Point Mortgage Trust

Company Spent Only a Month In Public Registration

Six Initial IPO Filings

Federal Street Acquisition, Which Was Founded by Executives of PE Firm Thomas H. Lee Partners, Registers $460 Million Offering

Blank Checks Company Will Focus Its Search for a Target In the Healthcare Industry

Federal Street’s Sponsor Has Agreed to Purchase $13.75 Million of Warrants In a Concurrent Private Placement

Vencore Holding, Provider of Systems Engineering and Integration, Cybersecurity and Data Analytics Services, Registers

Company’s Customers are Intelligence, Defense and Space Agencies Including NASA, the Department of Justice and the NSA

Vencore Will Continued to Be Controlled by PE Firm Veritas Capital Following the IPO

Citigroup, Lead Manager for Federal Street Acquisition, Also Will Lead Offering by New Registrant Calyxt

Minnesota-Based Company Provides Food Ingredients Developed Using Gene-Editing Technology

Calyxt Will Continue to be Owned by Cellectis Following the IPO

Kala Pharmaceuticals, Developer of Mucus Penetrating Particle-Based Therapies for Eye Diseases, Registers

Company Is Backed by Multiple Venture Capital Investors

14 Pharmaceutical Preparations Companies Have Publicly Registered and 11 Have Gone Public This Year

PetIQ, Which Will Undergo a Corporate Reorganization to Prepare for the IPO, Registers $85 Million Offering

Company Makes Prescription-Grade Medications, Other Health and Wellness Products for Dogs and Cats

Only SIC 5122 (Wholesale-Drugs, Proprietaries & Druggists’ Sundries) IPO Executed In Past Ten Years Was In October 2014

Yoga Instruction Provider YogaWorks Registers Plans for $74.75 Million IPO

Company Is Controlled by PE Firm Great Hill Partners, Which Has Indicated an Interest In Purchasing IPO Shares

YogaWorks Has Recapitalized Preferred

Shares and Notes, and Will Effect Stock Split Prior to the

Offering

No IPO Withdrawals

No Forms RW Filed for Seventh Straight Week; Q2 Likely to be Slowest for Withdrawals In More Than a Decade

| IPO Offerings | Form Type |

1st Lead Manager

Listed |

Initial Filing Date | Offer Date |

|---|---|---|---|---|

| Bison Capital Acquisition Corp. | 424B4 | EarlyBirdCapital, Inc. | 5/31/17 | 6/19/17 |

| Constellation Alpha Capital Corp. | 424B4 | Cowen and Company, LLC | 5/18/17 | 6/19/17 |

| Altice USA, Inc. | 424B4 | JPMorgan Securities LLC | 4/11/17 | 6/21/17 |

| Safety, Income and Growth, Inc. | 424B1 | BofA Merrill Lynch | 4/10/17 | 6/21/17 |

| Hennessy Capital Acquisition Corp. III | 424B4 | Credit Suisse Securities (USA) LLC | 5/30/17 | 6/22/17 |

| Granite Point Mortgage Trust Inc. | 424 | JPMorgan Securities LLC | 5/24/17 | 6/23/17* |

| Initial IPO Filings | Form Type | 1st Lead Manager

Listed |

Initial Filing Date | |

|---|---|---|---|---|

| Federal Street Acquisition Corp. | S-1 | Citigroup Global Markets Inc. | 6/20/17 | |

| Vencore Holding Corp. | S-1 | Goldman Sachs & Co. LLC. | 6/21/17 | |

| Calyxt, Inc. | S-1 | Citigroup Global Markets Inc. | 6/23/17 | |

| Kala Pharmaceuticals, Inc. | S-1 | JPMorgan Securities LLC | 6/23/17 | |

| PetIQ, Inc. | S-1 | Jefferies LLC | 6/23/17 | |

| YogaWorks, Inc. | S-1 | Cowen and Company, LLC | 6/23/17 |

| IPO Withdrawal | Form Type | 1st Lead Manager

Listed |

Initial Filing Date | Withdrawal Date |

|---|---|---|---|---|

| No IPO Withdrawals | -- | -- | -- | -- |

*While Granite Point Mortgage Trust Inc.'s Form 424 was not available on sec.gov

by press time, the company's IPO shares started trading on Friday, June 23rd.

IPO Vital Sign of the Month

#324 - SIC Codes

Use IPO Vital Sign #324 to…

- Review the number and percentage of companies going public in each SIC Code

- Analyze trends over time

and drill down into the different SIC Codes to see

- IPO issuers’ company names and business descriptions

- Review “Prospectus Summary” first paragraphs (Final Prospectus business descriptions)

- Issuers’ headquarters by country and state

- Offer amounts

- Offer dates

IPO Vital Sign Tips & Tricks

Click on blue numbers to drill down for more information.

Select a number of issuers’ final prospectus business descriptions by clicking in the boxes of those you wish to review in the fourth column (placing a check-mark in each box), and clicking the [COMPARE] button at the top of the fifth column.

IPO News Desk

Willing to Wait: RWs Dwindle as Companies Try to Get IPO Timing Right

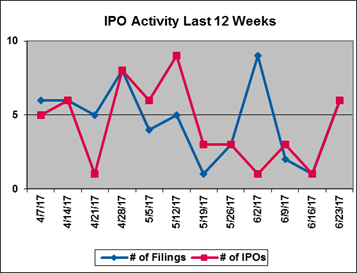

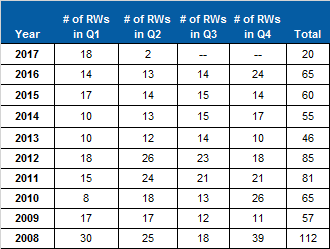

The IPO market enjoyed a productive second quarter in which 50 deals were completed (through June 20th) compared to 28 in the first quarter. Noteworthy among the second quarter IPO statistics is the low number of withdrawals. With only a week remaining in the quarter, only two Forms RW have been filed since the beginning of April. Barring a rush of withdrawals before the end of June, it will be the lowest quarterly total for RWs in the past ten years. The only other quarter with an RW count in the single digits during that time period was the first quarter of 2010 with 8.

As of June 20th, the market had gone seven consecutive weeks without the withdrawal of a preliminary registration. The drought suggests a slowdown in M&A activity, which is one reason companies pull out of planned IPOs. In addition, IPO hopeful companies seem willing to wait to get the timing of the offering right, rather than choosing to cut and run.

The reason most often cited for an IPO withdrawal is adverse market conditions. At the moment, the broader market is strong, giving companies in the IPO pipeline no reason to abandon their plans. Other factors are favorable as well. Deals are getting done relatively quickly this year with 46% of 2017’s IPOs being completed within 30 days of initial public registration. In addition, 57% of new issues have priced within their initial price range. In the aftermarket, 41 of the year’s 76 IPOs are currently trading above their offering price.

Since the start of 2017, there have been 20 withdrawals. At the current rate, this will be the slowest year for RWs in the past decade. Currently, 2013 claims the lowest total in the past decade with 46 withdrawals. Between 2008 and 2014, the average number of IPO withdrawals per year was 72. Last year there were 65 abandoned deals, and 60 in 2015. The 2008 through 2014 average was inflated by 2008, the year the global financial crisis took hold and112 companies withdrew IPO plans. It is the only time the RW count has topped 100 in the past 10 years.

Among the 20 companies that have withdrawn so far this year, half are non-U.S. companies. That includes the three most recent Form RW filings, and four of the last five. In 2016, only 23% (15 of 65) of the withdrawals were filed by non-U.S. companies. That is comparable to 2015 when 13 of the 60 (22%) abandoned deals were for companies headquartered outside the U.S. In 2011, 18 RWs were filed by non-U.S. companies, the highest annual total in recent years.

IPO Registrations Withdrawn

2008-2017*

(*Data through June 20, 2017)

IPO Vital Signs Subscribers see,

#1002. IPO Withdrawals

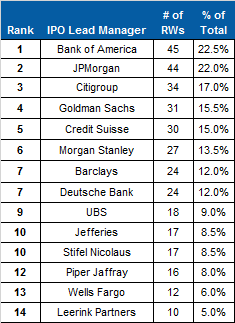

Lead Managers - Of the 200 registrations withdrawn since January 1, 2014, Bank of America was lead manager on the largest number (45). The investment bank was listed as lead underwriter on 22.5% of proposed offerings that were pulled over the past four and a half years. Bank of America was the sixth busiest lead underwriter of completed IPOs in that same period with 117 new issues.

JPMorgan was the busiest lead manager of IPOs between January 1, 2014 and June 20, 2017 with 153 Pricings. It was lead underwriter on 44 withdrawn IPOs (22%) since the start of 2014, the second highest total behind Bank of America. The two investment banks have each tallied five RWs so far in 2017, tying it for first place this year. Five banks are tied for third this year with three withdrawals apiece.

Since January 1, 2014, Citigroup has worked on 34 withdrawn deals, the third most over the past several years, and three ahead of Goldman Sachs. Credit Suisse rounds out the top five with 30 withdrawals in the 2014 through June 2017 timeframe.

IPOs Withdrawn 2014 – 2017*

IPO

Lead Managers

With at Least Ten RWs

(*Data

through June 20, 2017)

IPO Vital Signs Subscribers see,

#1055. IPO Withdrawals - IPO

Lead Managers

The IPO Line-Up

IPO Line-Up Falls One to 41 Eight-Week Active Registrants

Seven Initial Price Ranges Filed

Federal Street Acquisition Sets Price Range In Its Initial Public Registration

Pharmaceutical Prep Companies Aileron Therapeutics, Dova Pharmaceuticals and Akcea Therapeutics Establish Price Ranges

Three Filers Amend Their Public Registrations for the First Time, Determine Price Ranges:

Byline Bancorp, Blue Apron Holdings and Esquire Financial Holdings

Eight Other Registrants File Amendments

Avenue Therapeutics Changes First Lead Manager from Raymond James to Oppenheimer

Four Springs Capital Trust and TPG Pace Holdings Amend Registrations Twice In Latest Week

Contura Energy and Gadsen Growth Properties Amend Registrations for the First Time

IPO Line-Up

(Ranked by Initial Filing Date)

The IPO Line-Up contains IPO Registrants that have had filing activity in the last 8 weeks

and have not gone public or withdrawn from registration.

IPO Registrants that are red and bold indicate that a filing with the initial IPO price range has been filed with the SEC.

| IPO Registrant | Form Type | 1st Lead Mgr Listed | Initial Filing Date | Filing w/ Initial Price Range | 5/1 - 5/5 | 5/8 - 5/12 | 5/15 - 5/19 | 5/22 - 5/26 | 5/29 - 6/2 | 6/5 - 6/9 | 6/12 - 6/16 | 6/19 - 6/23 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| YogaWorks, Inc. | S-1 | Cowen and Co. | 6/23/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| PetIQ, Inc. | S-1 | Jefferies | 6/23/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Kala Pharmaceuticals, Inc. | S-1 | JPMorgan | 6/23/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Calyxt, Inc. | S-1 | Citigroup | 6/23/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Vencore Holding Corp. | S-1 | Goldman Sachs | 6/21/17 | -- | -- | -- | -- | -- | -- | -- | -- | S-1 |

| Federal Street Acquisition Corp. | S-1 | Citigroup | 6/20/17 | 6/20/17 | -- | -- | -- | -- | -- | -- | -- | S-1 |

| CompuLab Ltd. | F-1 | Maxim Group | 6/13/17 | -- | -- | -- | -- | -- | -- | -- | F-1 | -- |

| PQ Group Holdings Inc. | S-1 | Morgan Stanley | 6/9/17 | -- | -- | -- | -- | -- | -- | S-1 | -- | -- |

| TPG Pace Holdings Corp. | S-1 | Deutsche Bank | 6/7/17 | 6/7/17 | -- | -- | -- | -- | -- | S-1 | -- | 6/19;6/20 |

| Dova Pharmaceuticals, Inc. | S-1 | JPMorgan | 6/2/17 | 6/19/17 | -- | -- | -- | -- | S-1 | 6/9 | -- | 6/19 |

| Aileron Therapeutics, Inc. | S-1 | BofA Merrill Lynch | 6/2/17 | 6/19/17 | -- | -- | -- | -- | S-1 | -- | -- | 6/19 |

| Tintri, Inc. | S-1 | Morgan Stanley | 6/1/17 | 6/16/17 | -- | -- | -- | -- | S-1 | 6/6 | 6/16 | -- |

| Mersana Therapeutics, Inc. | S-1 | JPMorgan | 6/1/17 | 6/16/17 | -- | -- | -- | -- | S-1 | -- | 6/16 | -- |

| Blue Apron Holdings, Inc. | S-1 | Goldman Sachs | 6/1/17 | 6/19/17 | -- | -- | -- | -- | S-1 | -- | -- | 6/19;6/23 |

| Esquire Financial Holdings, Inc. | S-1 | Sandler O'Neill | 5/31/17 | 6/19/17 | -- | -- | -- | -- | S-1 | -- | -- | 6/19;6/22 |

| Byline Bancorp, Inc. | S-1 | BofA Merrill Lynch | 5/31/17 | 6/19/17 | -- | -- | -- | -- | S-1 | -- | -- | 6/19 |

| Four Springs Capital Trust | S-11 | RBC Capital | 5/24/17 | 6/13/17 | -- | -- | -- | S-11 | -- | 6/7 | 6/13 | 6/19;6/20 |

| Ranger Energy Services, Inc. | S-1 | Credit Suisse | 5/22/17 | -- | -- | -- | -- | S-1 | -- | -- | 6/13 | -- |

| Oasis Midstream Partners LP | S-1 | Morgan Stanley | 5/12/17 | -- | -- | S-1 | 5/17 | -- | 5/30;6/2 | -- | -- | -- |

| Loton, Corp | S-1 | BMO | 5/11/17 | -- | -- | S-1 | -- | -- | -- | -- | 6/14 | -- |

| US LBM Holdings, Inc. | S-1 | Barclays | 5/9/17 | -- | -- | S-1 | -- | -- | -- | -- | -- | -- |

| Contura Energy, Inc. | S-1 | Citigroup | 5/8/17 | -- | -- | S-1 | -- | -- | -- | -- | -- | 6/22 |

| Venator Materials PLC | S-1 | BofA Merrill Lynch | 5/5/17 | -- | S-1 | -- | -- | -- | -- | -- | 6/13 | -- |

| Gadsden Growth Properties, Inc. | S-1 | National Securities | 5/5/17 | -- | S-1 | -- | -- | -- | -- | -- | -- | 6/21 |

| Advantage Solutions Inc. | S-1 | Goldman Sachs | 5/4/17 | -- | S-1 | -- | -- | -- | -- | 6/9 | -- | -- |

| Nine Energy Service, Inc. | S-1 | JPMorgan | 5/2/17 | -- | S-1 | -- | 5/19 | 5/24 | -- | -- | -- | -- |

| GPM Petroleum LP | S-1 | Raymond James | 4/28/17 | -- | 5/5 | -- | -- | -- | 5/31 | -- | 6/14 | -- |

| Co-Diagnostics, Inc. | S-1 | WallachBeth | 4/28/17 | 6/9/17 | -- | -- | -- | 5/24 | -- | 6/9 | -- | 6/23 |

| Avenue Therapeutics, Inc. | S-1 | Oppenheimer | 4/28/17 | 5/19/17 | -- | -- | 5/19 | -- | -- | -- | -- | 6/23 |

| TPG RE Finance Trust, Inc. | S-11 | BofA Merrill Lynch | 4/25/17 | -- | -- | -- | -- | -- | 5/30 | -- | -- | 6/21 |

| Dole Food Company, Inc. | S-1 | Morgan Stanley | 4/24/17 | -- | -- | -- | -- | -- | 5/31 | -- | -- | -- |

| Hunting Dog Capital Corp. | S-1 | Joseph Gunnar | 4/19/17 | 5/24/17 | -- | -- | -- | 5/24 | -- | -- | 6/14 | -- |

| Newater Technology, Inc. | F-1 | ViewTrade | 4/18/17 | 4/18/17 | -- | -- | -- | -- | 6/2 | -- | -- | 6/20 |

| Vine Resources Inc. | S-1 | Credit Suisse | 4/10/17 | -- | 5/5 | -- | -- | -- | -- | -- | -- | -- |

| Frontier Group Holdings, Inc. | S-1 | Citigroup | 3/31/17 | -- | -- | 5/9 | -- | 5/23 | -- | -- | 6/12 | -- |

| Akcea Therapeutics, Inc. | S-1 | Cowen and Co. | 3/27/17 | 6/20/17 | -- | 5/9 | -- | -- | -- | -- | -- | 6/20 |

| Liberty Oilfield Services Inc. | S-1 | Morgan Stanley | 2/14/17 | -- | 5/2 | -- | -- | 5/23 | -- | -- | -- | -- |

| FTS International, Inc. | S-1 | Credit Suisse | 2/10/17 | -- | 5/5 | -- | -- | -- | -- | -- | -- | -- |

| Frankly Inc. | S-1 | Roth Capital | 11/10/16 | 5/11/17 | -- | 5/11 | 5/19 | 5/22 | 6/2 | -- | 6/16 | -- |

| Mota Group, Inc. | S-1 | Joseph Gunnar | 10/5/16 | 4/25/17 | -- | 5/9 | 5/16 | -- | -- | -- | -- | -- |

| Albertsons Companies, Inc. | S-1 | Goldman Sachs | 7/8/15 | -- | -- | 5/11 | -- | -- | -- | -- | -- | -- |

IPO Line-Up includes all IPO registrants that have filed to go public in the U.S., have neither gone public nor formally withdrawn their offering by filing a Form RW with the SEC, and have had filing activity in the most recent eight week period. IPO Line-Up includes all SEC registered IPOs, including REITs and those non-U.S. IPO filers seeking to list in the U.S. markets, except for 1) closed-end funds; 2) best-efforts, self-underwritten, and direct offerings; and 3) small business IPOs with an offering amount of less than $5 million. IPO Line-Up: Recent SEC IPO Filing Activity is based on information provided from the IPO Vital Signs System located at https://www.ipovitalsigns.com/