The IPO Week in Review is an important element of

the IPO Vital Signs System, an advanced IPO research analysis

tool that assists IPO professionals and pre-IPO companies satisfy

their most challenging research needs by answering hundreds of

mission critical questions.

Click here to go to

our homepage and learn more about IPO Vital

Signs.

Vol. XII, Issue 12

|

IPO |

|

|

News Desk |

Prescription for Success:

Drug Makers Continue IPO Market Dominance

3/24/14

-

The IPO market has been receptive to new issuers over the past 15

months, and few industries have taken advantage like the pharmaceutical

preparations sector has. Drug makers are on a roll, and there is no end

in sight for their market dominance. They finished 2013 as the busiest

SIC Code with 36 new issues, nearly double the 19 IPOs

for the second-best business,

real estate investment trusts. So far in 2014, pharmaceutical

preparations companies have accounted for 41% of the year’s deals. The

20 SIC 2834 offerings mark a performance five times better than that of

the next closest industry (oil and gas companies).

Not only are they prevalent, but pharmaceutical preparations IPOs have

been well received by investors. Of all deals completed since the

start of 2013, the four best aftermarket performers as of March 19,

2014 are drug makers. They are

Insys Therapeutics (+771%),

GW Pharmaceuticals (+718%),

Relypsa (+298%) and

Receptos (+277%). Six of the top ten aftermarket performers over

the past 15 months are pharmaceutical preparations companies (IPO

Vital Signs Subscribers see VS #299. IPO Aftermarket Performance by

SIC Code).

The strong performance by many SIC 2834 stocks is one of the reasons

that new registrants from this industry are flocking to the public

markets. Of the 80 new registrations filed his year, 19 have been by

pharmaceutical companies. The filings are coming at a faster pace than

last year. In 2013, 47 pharmaceutical preparations companies submitted

new registrations, but only eight of those were filed in the first

quarter. The fourth quarter of last year is when the industry really

began to gain momentum as 20 companies publicly registered their

prospective offerings.

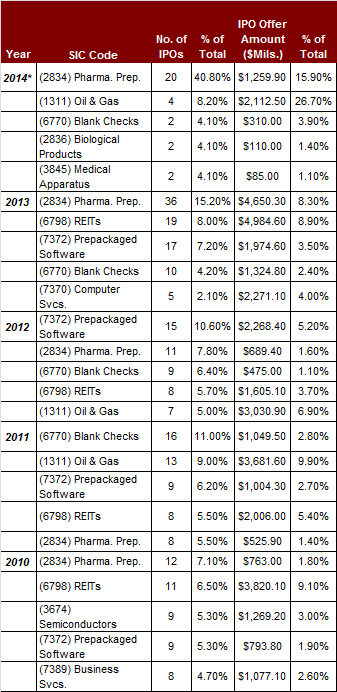

Other SIC Codes

- Pharmaceutical companies easily outdistanced other industries in

2013 with a 15.2% share of the market, and 2834 has been among the top

five SIC Codes in each of the past four years. The sector was second

in 2012 with 11 IPOs, behind prepackaged software companies (SIC

7372), another industry that annually ranks among the top five SIC

Codes. In 2012, software companies claimed the top spot with 15 deals

(a 10.6% market share). Pharmaceutical preparations deals fell to

fifth place in 2011 with 8 IPOs after finishing first in 2010 (12

deals and 7.1% of the market).

Real estate investment trusts (SIC 6798), which finished second last

year with 19 offerings, have yet to make an appearance in the 2014 IPO

market. REITs are another group that is perennially in the top five of

the year-end SIC Code performance rankings. The industry finished

fourth in 2012 and 2011 with 8 deals in each year, and second in 2010

with 11 IPOs. The slow start this year by REITs is surprising, as is

the one deal completed year-to-date by the prepackaged software

industry.

Conversely, oil and gas companies (SIC 1311) are off to a great start in 2014. The industry has already seen four IPOs, the same number of deals it completed in all of 2013. However, no new registrations have been filed by SIC 1311 companies yet in 2014, so the group’s IPO total may slow in the coming months. Only two blank checks companies (SIC 6770) have completed IPOs so far in 2014, placing the industry in a third place tie with SIC 2836 (Biological Products) and 3845 (Electromedical and Electrotherapeutic Apparatus). Blank checks led all SIC Codes in 2011 (16 IPOs, 11% of the market), and finished third and fourth in 2012 and 2013, respectively.

Top Five IPO SIC Codes

2010 - Present

(*Through March 16, 2014)

IPO Vital Signs Subscribers see, #324. SIC Codes

Banks Behind the Industries -

As it is common for investment banks to handle multiple deals within

the same industry, it has definitely been the case for the

pharmaceutical preparations industry in 2014. Four of the top five

spots in the ranking of lead managers by industry sector are occupied

by banks that worked on biotech and pharmaceutical new issues.

Jefferies,

Cowen and Co. and

Stifel, Nicolaus have led five such IPOs apiece, and

U.S. Bancorp Piper Jaffray

is close behind with four.

Leerink Partners

is in the top five this year, having served as first lead manager on

three biotech/pharmaceuticals deals. The underwriter specializes in

the health care industry - all of its 23 lead manager assignments

since the start of 2011 were in the health care field, with 20 of them

being pharmaceuticals preparations companies. Leerink led 13

biotech/pharmaceuticals IPOs in 2013, which earned it a first place

tie for most new issues by one lead manager in one industry.

Citi also had 13 lead manager assignments last year in one industry

- the energy and natural resources sector.

The success of energy IPOs in 2012 was good for Citi and several other

investment banks, including

Barclays Bank, Bank of

America Merrill Lynch and

Morgan Stanley. The strongest industry-lead manager link in the

IPO market that year was Citi’s 11 energy deals, followed by Barclays’

ten energy IPOs. BofA Merrill Lynch and Morgan Stanley each led nine

new issues by energy and natural resources companies in 2012. Morgan

Stanley displayed a balanced IPO business that year by also leading

eight deals for companies in the computer software and services

sector.

Top Lead Managers by Industry Sector

2010 - Present

(*Through March 16, 2014)

IPO Vital Signs Subscribers see, #106. IPO Lead Managers

I

©

2014 CCH, INCORPORATED. A WoltersKluwer Company; All Rights Reserved

IPO Week in Review is part of the IPO Vital Signs web service for IPO professionals

or can be obtained by separate subscription.

To learn more about the IPO Vital Signs service you can click here to visit our homepage,

or for subscription information you can visit the CCH Online Store

For more information about the IPO Week in Review e-newsletter click here.

To talk to a CCH Account Representative call (888) 224-7377.