IPO News Desk

Willing to Wait: RWs Dwindle as Companies Try to Get IPO Timing Right

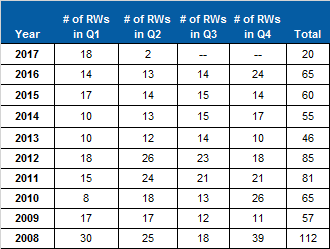

The IPO market enjoyed a productive second quarter in which 50 deals were completed (through June 20th) compared to 28 in the first quarter. Noteworthy among the second quarter IPO statistics is the low number of withdrawals. With only a week remaining in the quarter, only two Forms RW have been filed since the beginning of April. Barring a rush of withdrawals before the end of June, it will be the lowest quarterly total for RWs in the past ten years. The only other quarter with an RW count in the single digits during that time period was the first quarter of 2010 with 8.

As of June 20th, the market had gone seven consecutive weeks without the withdrawal of a preliminary registration. The drought suggests a slowdown in M&A activity, which is one reason companies pull out of planned IPOs. In addition, IPO hopeful companies seem willing to wait to get the timing of the offering right, rather than choosing to cut and run.

The reason most often cited for an IPO withdrawal is adverse market conditions. At the moment, the broader market is strong, giving companies in the IPO pipeline no reason to abandon their plans. Other factors are favorable as well. Deals are getting done relatively quickly this year with 46% of 2017’s IPOs being completed within 30 days of initial public registration. In addition, 57% of new issues have priced within their initial price range. In the aftermarket, 41 of the year’s 76 IPOs are currently trading above their offering price.

Since the start of 2017, there have been 20 withdrawals. At the current rate, this will be the slowest year for RWs in the past decade. Currently, 2013 claims the lowest total in the past decade with 46 withdrawals. Between 2008 and 2014, the average number of IPO withdrawals per year was 72. Last year there were 65 abandoned deals, and 60 in 2015. The 2008 through 2014 average was inflated by 2008, the year the global financial crisis took hold and112 companies withdrew IPO plans. It is the only time the RW count has topped 100 in the past 10 years.

Among the 20 companies that have withdrawn so far this year, half are non-U.S. companies. That includes the three most recent Form RW filings, and four of the last five. In 2016, only 23% (15 of 65) of the withdrawals were filed by non-U.S. companies. That is comparable to 2015 when 13 of the 60 (22%) abandoned deals were for companies headquartered outside the U.S. In 2011, 18 RWs were filed by non-U.S. companies, the highest annual total in recent years.

IPO Registrations Withdrawn

2008-2017*

(*Data through June 20, 2017)

IPO Vital Signs Subscribers see,

#1002. IPO Withdrawals

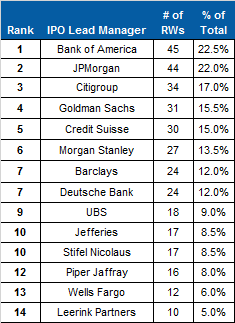

Lead Managers - Of the 200 registrations withdrawn since January 1, 2014, Bank of America was lead manager on the largest number (45). The investment bank was listed as lead underwriter on 22.5% of proposed offerings that were pulled over the past four and a half years. Bank of America was the sixth busiest lead underwriter of completed IPOs in that same period with 117 new issues.

JPMorgan was the busiest lead manager of IPOs between January 1, 2014 and June 20, 2017 with 153 Pricings. It was lead underwriter on 44 withdrawn IPOs (22%) since the start of 2014, the second highest total behind Bank of America. The two investment banks have each tallied five RWs so far in 2017, tying it for first place this year. Five banks are tied for third this year with three withdrawals apiece.

Since January 1, 2014, Citigroup has worked on 34 withdrawn deals, the third most over the past several years, and three ahead of Goldman Sachs. Credit Suisse rounds out the top five with 30 withdrawals in the 2014 through June 2017 timeframe.

IPOs Withdrawn 2014 – 2017*

IPO

Lead Managers

With at Least Ten RWs

(*Data

through June 20, 2017)

IPO Vital Signs Subscribers see,

#1055. IPO Withdrawals - IPO

Lead Managers